This is the HTML version of the report. You can also download the print version of the PDF (high resolution, with footnotes, 91mb) or the web version PDF (low resolution, links in the text, 5mb).

Table of Contents

- Foreword

- Introduction

- A complicated political context

- A systematic model for assessing Multimodal Digital Mobility Services

- Case Studies

- Case Study 1 – State incumbent railways refusing to sell other incumbents’ tickets

- Case Study 2 – Railway and coach companies refusing to share ticketing data makes efficient multimodal booking impossible

- Case Study 3 – Railway companies do not pass on best price tickets to third parties

- Case Study 4 – Missing railway ticketing data prevents passengers getting the best price on international trains

- Case Study 5 – Unfair commercial practices prevent development of multimodal platforms

- Case Study 6 – Multimodal and multi-operator single mode journeys without passenger rights

- Conclusions

Foreword

Imagine booking a trip by train from Stockholm to Madrid or Rome in one single click. Imagine easily planning your business trip from Brussels to a conference in Warsaw, choosing rail because it’s the most competitive offer. Imagine planning your family vacation across Europe by train and not having to worry about getting stranded somewhere along the way, due to delays.

Imagine booking a trip by train from Stockholm to Madrid or Rome in one single click. Imagine easily planning your business trip from Brussels to a conference in Warsaw, choosing rail because it’s the most competitive offer. Imagine planning your family vacation across Europe by train and not having to worry about getting stranded somewhere along the way, due to delays.

Millions of Europeans share this vision. Millions of Europeans want to choose sustainable travel, and to be able to combine transport modes for the best cross-country travel options. Just look at the success of the Deutschland-ticket and the night train renaissance – if given the opportunity people will change their travel habits. Build it, and they will come.

I love to travel by train and have covered most of Europe by rail: it’s not always the fastest mode of transport, but when everything works there is nothing like it.

The science is clear – in order to meet our climate targets the transport sector needs to transform at a rapid pace. We need a modal shift – away from inherently unsustainable modes of transportation such as aviation and road, to the inherently most sustainable option – the railway.

Unfortunately, the challenges facing train passengers today are numerous, especially if you want to travel cross-border. One of the main issues is just how difficult it is to understand how to book your trip and get your tickets, as well as the lack of passenger rights once you are on your way. Passengers find themselves stranded far from their destinations, without sufficient support and information from the train operators.

Anyone travelling by train should enjoy at least equal rights to air travellers. You should be able to use open booking systems to purchase trans-european journeys with several providers, without losing your rights to reimbursement or compensatory travel, in case of delays and cancellations.

It is the responsibility of legislators, train and rail operators to create favourable conditions, so that citizens can live and travel sustainably. As a Member of the European Parliament, I have taken every opportunity to call for new legislation at an EU-level in order to address these issues, which are solvable. Until now the EU has failed to deliver the solution. This urgently needs to change.

It is therefore my great pleasure to present this report on Multimodal Digital Mobility Services, which provides a detailed analysis of the current problems and what is required to solve them, in order to make multi-modal passenger travel easy and reliable across the EU.

Jakop Dalunde

Member of the European Parliament, Greens/EFA (Miljöpartiet de Gröna)

(⬆ Return to the Table of Contents ⬆)

Introduction

“Planning and buying tickets for multimodal journeys is much too often much too cumbersome for travellers in the EU.” So starts the European Commission’s Inception Impact Assessment on Multimodal Digital Mobility Services (MDMS).

Acknowledging that problem is the start. Setting about trying to fix the problem is much more complicated.

However the issue is even more deep-seated than the Commission diagnoses, for it is not only multimodal tickets that are often a hassle to purchase. Tickets for the same mode where more than one operator is involved are a headache as well.

In all of these circumstances passengers are left with an almost incomprehensible series of options. Often a route cannot be easily planned. If it can be planned, a ticket or tickets cannot be bought for it in one transaction. Even if it can be purchased, real-time data is not available or passenger rights are unclear in the case of something going wrong.

These problems particularly affect the greenest long distance public transport modes, railways and long distance buses, where combining modes and operators presents more difficulties than in air transport, especially if you want to travel across one or more border.

The climate change imperative is obvious here. Transport is the only sector of Europe’s economy where carbon emissions are today above 1990s levels, and where emissions continue to rise. At the very least the EU needs to make sure a greener alternative to a car journey or a flight is as simple to plan and book as possible, yet we are a long way away from that reality currently.

This report therefore has a simple aim: to explain what legislative changes are necessary at European Union level to address the challenges customers face in order for them to more easily plan and purchase multimodal and multi-operator trips, and hence be able to make greener travel choices.

Passengers choosing multimodal or multi-operator trips should not be disadvantaged in terms of the quality of information about disruptions to their journey, or in terms of their passenger rights, in comparison to those making single mode and single operator journeys.

(⬆ Return to the Table of Contents ⬆)

A complicated political context

Transport policy has traditionally been pursued on a mode-by-mode basis by the European Commission, leading us to the current situation where the legal framework for multimodal mobility is complicated and inadequate.

“Multimodal digital mobility services (MDMS) are currently deployed in a fragmented manner, lacking proper legal and market frameworks to develop more successfully and to provide a full range of offers across the EU,” the Commission notes.

That specific multimodal issue has prompted a lot of thinking and discussion both within the European Commission and between the European Commission, the European Parliament and stakeholders from across the transport industry, but attempted multimodal solutions have come up against opposition in different quarters.

Not all modes are currently easy to combine with other modes. It is also clear that all of this effort within the EU is not only about multimodal trips, but also about addressing some of the perceived issues within some modes, and within rail in particular. As the case studies below will show, combining rail tickets of different operators has its very specific set of problems, and so a heavier focus on rail as part of the multimodal mix makes sense. However this has led to rail industry lobbyists arguing that their mode of transport is somehow more in the firing line than others – with some justification.

Former European Commission Vice President Frans Timmermans contributed most strongly to this emphasis on rail when he demanded railway companies come up with a solution for the lack of robust cross-border ticketing by the end of 2022. “If they don’t, we will enforce it legally. I’m sick of it,”

he stated in September 2022. The Action Plan (see Annex 1, Point 37) in the European Commission’s 2020 Sustainable and Smart Mobility Strategy also specifically states rail ticketing will be included in a future multimodal legislative proposal, while other modes are not explicitly mentioned.

However, at the time of writing in early 2024, no such legislation has been published, because a purported draft of a Regulation on multimodal ticketing (known commonly as the “MDMS Regulation” (this paper seeks to avoid this terminology)) was shelved in October 2023. By this time Timmermans had departed the European Commission to return to Dutch politics, and had left the issue to European Commissioner for Transport Adina Vălean who did not share his commitment to the cause.

Community of European Railways (CER) – the lobby of the state-owned railway companies – is well aware that the European Commission has its sights on rail as the mode most in need of improvement as part of a functioning multimodal ecosystem, and has been mounting a defence of sector-based (i.e. rail only or rail first) and non-legislative solutions. CER expresses it thus: “In order to achieve seamless ticketing, sector-based solutions should be supported and considered as the starting point for improving multimodal ticketing.”

As the case studies later in this report will demonstrate, this approach is both inadequate for rail alone and will also fail to facilitate multi-operator and multimodal journeys.

CER has been keen to emphasise that its rail-specific solutions – the older Railteam Alliance, and the newer Agreement on Journey Continuation (AJC), are adequate for passengers. However the limited scope of Railteam, and the obligation that an onward journey has to be with the same operator in the case of AJC, means that both of these arrangements are inadequate. Neither offers rights that a passenger can enforce but everything is at the discretion of railway operators. Worse still, neither work in the case of multimodal journeys.

Lined up on the other side of the argument – in favour of a wide-ranging set of legislative proposals – is a loose alliance of organisations that represent passengers, consumers, environmental organisations, travel companies and private railway companies and call themselves “Friends of MDMS”. What upsides they see to addressing multimodal mobility at EU level do however have some differences of emphasis that will also be examined in the conclusions of this report.

What anyone with an interest in this topic can agree on is that – with the European Parliament elections on the horizon in mid-2024 – there is no realistic prospect of any legislation being proposed until 2025 at the earliest, although discussion will of course continue politically until then. A new European Commissioner for Transport cannot avoid re-examining this issue, while a newly constituted European Parliament Committee on Transport and Tourism (TRAN) after the elections might also approach the topic with fresh eyes. Opposition to far-reaching legislation will still exist within the Council of the European Union, where Member States will seek to defend their national carriers (be they airlines or rail companies) or their national industries, rather than seek to solve multimodal ticketing problems EU-wide.

(⬆ Return to the Table of Contents ⬆)

A systematic model for assessing Multimodal Digital Mobility Services

The problem with any policy discussion inside the Brussels EU bubble is it becomes very self-referential – what is to be done is a function of what has been done in EU law in the past, and technical terms and jargon are used by the players in the discussion about a topic, often with the effect of keeping outsiders out.

The problem with any policy discussion inside the Brussels EU bubble is it becomes very self-referential – what is to be done is a function of what has been done in EU law in the past, and technical terms and jargon are used by the players in the discussion about a topic, often with the effect of keeping outsiders out.

The discussion around Multimodal Digital Mobility Services (MDMS) is a case in point. The very term has been used interchangeably to mean the Service or Services that a customer can purchase, and in a specific context lobbyists have referred to a purported “MDMS Regulation” – the specific legislative draft that did not get published as planned in October 2023 and would have specifically addressed the Trip Purchase aspect of multimodal mobility services.

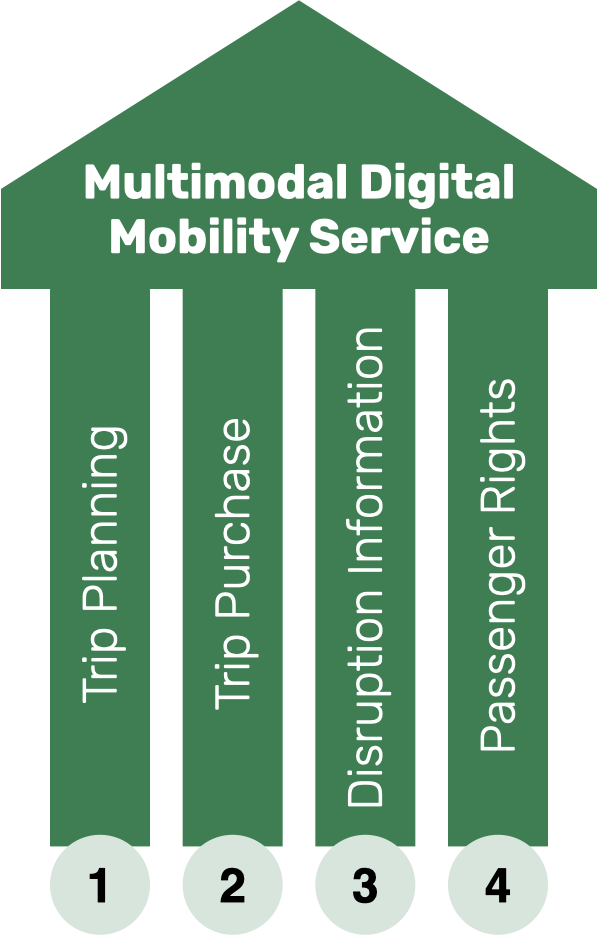

This paper takes a different approach. It takes a step back and examines the four components a passenger needs from a Multimodal Digital Mobility Service. These are:

- Trip Planning

- Trip Purchase

- Disruption Information

- Passenger Rights

Each of these components will be addressed in turn, and short case studies will then develop the aspects of each.

(⬆ Return to the Table of Contents ⬆)

Trip Planning

Before a customer can make a purchase, they need a simple and reliable way to plan a route. The assumption here is that a route is planned using digital data – that the customer themselves accesses through digital means (web browser, smartphone, ticket machine) or an intermediary accesses for them (a salesperson at a ticket office, a travel agency).

Common complaints about this component of the booking process are timetables missing from digital planners (some modes missing, some operators missing, or a combination of both), data not available far enough into the future, and data not updated in the case of network disruptions. Some examples of these deficiencies will be presented later in the report.

There are three possible roots of these problems. Does the legal framework exist to mandate the planning data to be published in the form required, at the time required? If the framework does exists, are transport operators and governmental organisations actually fulfilling their legal requirements, or is there a problem of impelmentation? If the data does exist, are existing travel planners not using it?

Route planners – for their rail component – have traditionally been based on UIC Merits data, but the €50000 price tag to access this data acts as a strong disincentive for small startups. Further gaps in the data in Merits – some entire countries missing, and in other cases including just some services – further limit its usefulness. The European Union has been reticent about mandating another international organisation to fix these issues.

Two existing pieces of legislation at EU level – a 2010 Directive and 2017 Delegated Regulation – have just been supplemented by a further Delegated Regulation in November 2023 to set the framework for timetable data.

The most significant aspect for our purposes here is the 2017 Delegated Regulation mandating the establishment of National Access Points for transport data, and the MOTIS Project of the Technical University of Darmstadt has demonstrated how to build a multimodal trip planner based on this National Access Point data. The demo of this tool is at https://europe.motis-project.de/ and the background at https://motis-project.de/

That a university can manage to build a route planning tool using data that is already available in the public domain, and that this data is kept up to date, demonstrates that this problem is not legislative nor a problem of implementation. If other route planning tools are missing data, then they are using the wrong data sources, or, for the countries other than the ones for which MOTIS has integrated into its tool, there might be an implementation problem (and hence the Commission must to be tasked with investigating these).

To put it another way: the solution for problems with route planning data is not about new legislation, but – at the margin – about better implementation of existing legislation.

(⬆ Return to the Table of Contents ⬆)

Trip Purchase

Once a trip is planned, a customer needs to be able to be shown a price to purchase that trip, and for that price to be compared with other options for the same journey – including trips using other modes and other operators in the same mode as their initial preference.

The problems here are well known, and once a trip involves two modes, or two operators in the same mode (especially cross-border), customers are often left struggling.

The complete absence of pricing information for some train and coach operators on third party platforms (as will be shown in the case studies below) demonstrates that this aspect can only be solved legislatively – an adequate legal framework is missing. The Regulation that was not published in October 2023 was supposed to address this.

What obligations should be placed on transport operators regarding the data that they share with third parties? Should it simply be a commercial decision as to what data to share or not, or should there be a data sharing obligation regardless of mode?

When a ticket is to be purchased, should that purchase be on the website of the operator (so-called re-linking) or should the payment process itself be possible on the third party platform (so-called re-selling)?

If re-linking is to be the way forward, can that be done in a way that customers can compare the prices of all offers in one place and book in one transaction? It is difficult to see how re-linking can allow a customer to book their entire trip in one transaction, which means this option is insufficient.

If re-selling is the chosen route, reselling must be on the basis of FRAND (fair, reasonable, and non-discriminatory) terms – with recourse to address non-compliance with those principles. FRAND is crucial to allow third party vendors to sell multimodal mobility services that operators do not, to build a business case to do so, whilst ensuring operators are not unfairly burdened by data sharing obligations.

In order to ensure transparency and a customer-friendly experience, the criteria that apply to any platform or service that allows customers to compare offers are also going to have to be addressed. For example, should criteria such as environmental impact of the journey be shown to customers, as a matter of obligation? And if this is the case, does the same obligation apply to single-mode portals as well? And should portals have the right to highlight tickets for which they receive greater commission than other offers?

It is not our concern who owns such platforms or tools to allow customers to compare and purchase multimodal and multi-operator trips – tools that are run by state owned transport operators or private companies are equally valid. It is the price comparison function, across modes, and the ability to purchase in one transaction, and ensure passenger rights are guaranteed, that are the crucial components.

(⬆ Return to the Table of Contents ⬆)

Disruption Information

Once a trip has been purchased – and this might well happen many months ahead of the journey actually taking place – information about disruptions needs to be conveyed to the customer. This information will take two forms – changes to timetables as a result of disruption known long ahead (e.g. maintenance work) that allow a passenger to re-plan or cancel their trip before they set off, and live information conveyed during the trip with estimations of arrival and departure times of vehicles, and whether connections will be reached or missed.

There are obvious problems with this component of the booking process at present.

First, real-time data for some operators and modes is incomplete at best. While data on departure and arrival of all commercial airliners is readily available, such information about trains and buses is either patchy, inaccurate or non-existent in many Member States.

Second, for both previously known and real-time disruptions, disruption information is not shared with third party platforms as a matter of course – meaning that after having purchased a trip, a passenger might need to query other information sources, websites or apps to know whether their journey is disrupted (and indeed those apps might also offer trip sales – and disruption data availability is used as a means to lock in users).

Here the MOTIS Project demonstrates what is technically possible – where live data on vehicle positions is available to third parties it can be mapped, but this is not the case for most of Europe (see Figure 1).

This point also builds upon the re-selling and re-linking point above. If a purchase transaction were to be conducted on the operator’s platform (re-linking), that also implies that disruption information would also be provided that way, meaning a customer purchasing a re-linked multimodal or multi-operator journey would have to query multiple sources of information about disruption.

Here the Delegated Regulation in November 2023 offers some potential change for the better, although the short time between the Regulation being published and this report going to press means there is no details yet on its practical impact. The Regulation states that data from Access Points may be licensed, but “conditions shall not unnecessarily restrict possibilities for reuse or be used to restrict competition […] Any financial compensation shall be reasonable and proportionate to the legitimate costs resulting from providing and disseminating the relevant travel and traffic data.”

This means that problems with disruption information are similar to those with trip planning, namely they are either legal implementation failures (and especially because of the implications of a Regulation that is so fresh), or possibly booking tools are not using data that is available. New legislation is likely not necessary here. Case Study 5 below develops this aspect in more detail.

(⬆ Return to the Table of Contents ⬆)

Passenger Rights

If something goes wrong on a journey, who deals with the consequences? The problems here from the passenger point of view are all too clear – if a passenger has booked a multimodal journey, and something breaks down on an early leg of the trip, they are left to fend for themselves later on without rights to continue their journey or any entitlement to compensation or assistance if, for example, they need accommodation having been left stranded.

The EU’s approach to this issue has for the past two decades been mode by mode, with separate legislation for air, rail, coaches and ships. It is with that in mind that in November 2023 the European Commission proposed a new draft Regulation on passenger rights in the context of multimodal journeys.

How the proposal defines a multimodal trip is however deeply problematic: “’multimodal journey’ means a journey of a passenger between a point of departure and a final destination covering at least two transport services and [my emphasis] at least two modes of transport”.

We know that in one mode in particular – rail – there is additionally the problem with single mode, multi-operator journeys, where a passenger is left relying on in-transparent and difficult to use informal agreements between operators in the case of disruption (more detail here) because there is no legal framework covering that sort of circumstance.

The Proposal also does not adequately address how passengers needing assistance are to be aided in multimodal journeys, and here too improvement will be required from the European Parliament and the Council.

What has to happen here is clear – that customers (whatever their needs) must not be disadvantaged in terms of passenger rights if they choose a multimodal or multi-operator journey, and what a passenger’s rights are need to be communicated up front at the start of the booking process.

The mechanism for a passenger to exercise their rights also has to be streamlined, with the passenger offered a single point of contact for any claim (again a re-linking system, as outlined above, would not achieve this), and this point of contact would logically be the ticket vendor. While the compensation system would be handled by the vendor, the reimbursement would have to be financially organised between the transport operators – making the vendor financially liable would hinder the development of platforms offering multimodal services, as the financial risk would be too high. Again, a clear legal framework with obligations for terms of agreements to be concluded according to FRAND principles is needed.

Here, in the same way as for Trip Purchase, the problems are nearly all legislative, with the only difference being that the proposed Regulation has at least been published. The legal framework to ensure passenger rights are protected for multimodal trips needs to be established and agreed, and indeed even widened to address the so far unaddressed problems for single-mode multi-operator trips as well.

(⬆ Return to the Table of Contents ⬆)

Case Studies

This section of the report takes the theoretical and legal problems with Multimodal Digital Mobility Services and examines the real life practical hurdles passengers face when booking multimodal trips, and multi-operator trips within the same mode. These cases highlight the problems that need to be addressed EU wide.

(⬆ Return to the Table of Contents ⬆)

Case Study 1 – State incumbent railways refusing to sell other incumbents’ tickets

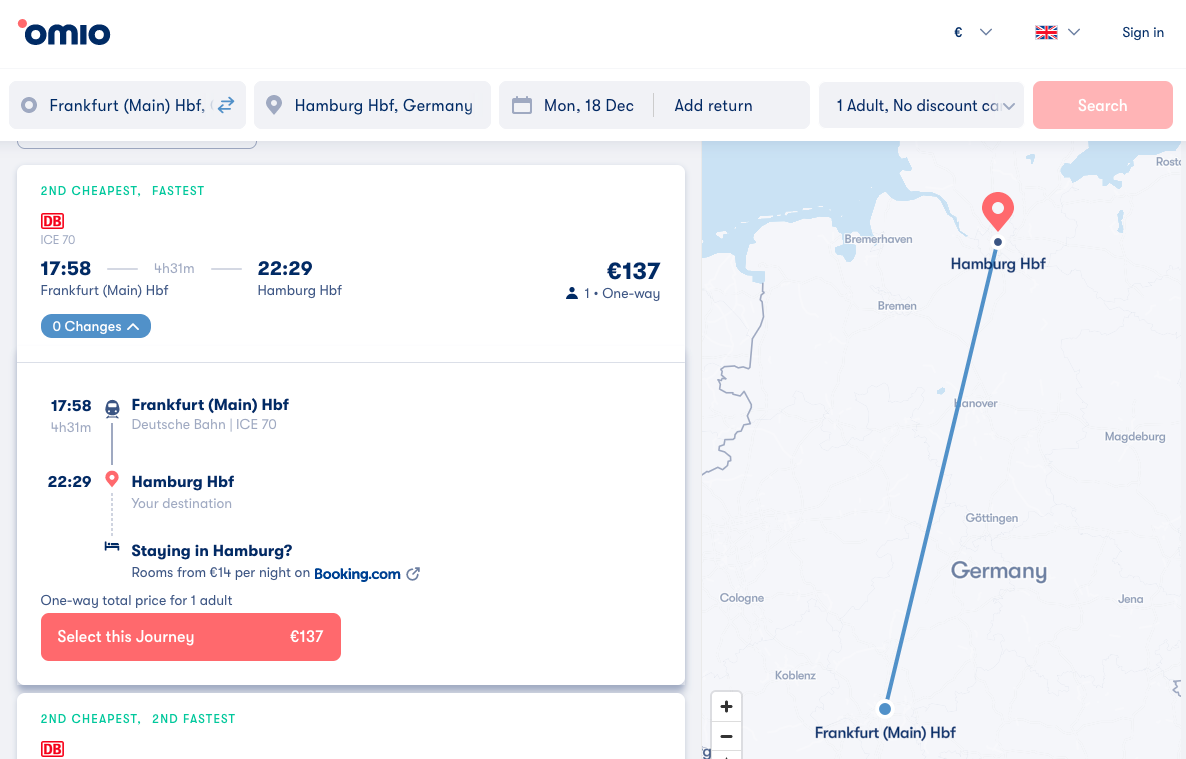

Community of European Railways states in its position paper on MDMS: “No obligation to sell competitors’ tickets – Railway undertakings need the entrepreneurial freedom while developing their businesses. This includes the freedom to engage in commercial agreements with ticket vendors and other transport operators to develop and improve their services.” But the behaviour of two of CER’s member companies towards each other show how customers lose out in situations where alternative tickets are not shown to customers on the webpages they use to plan and book their trips, limiting their options.

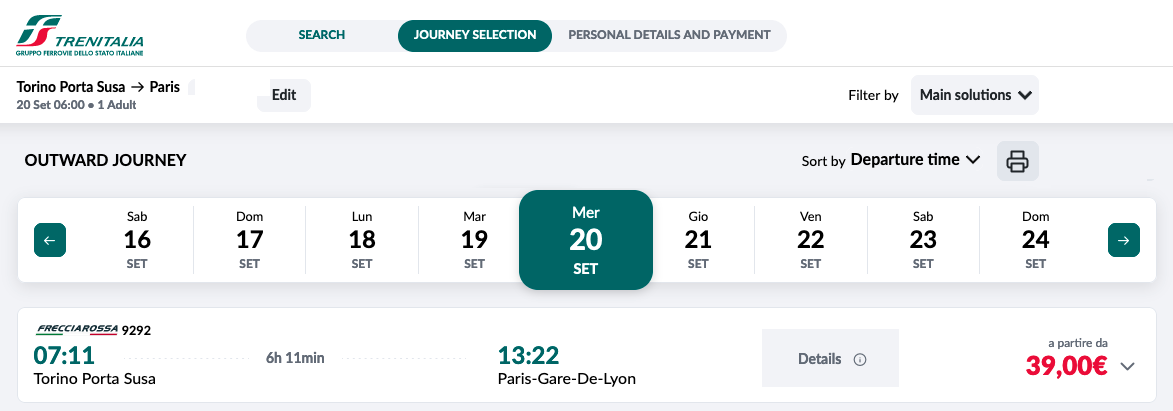

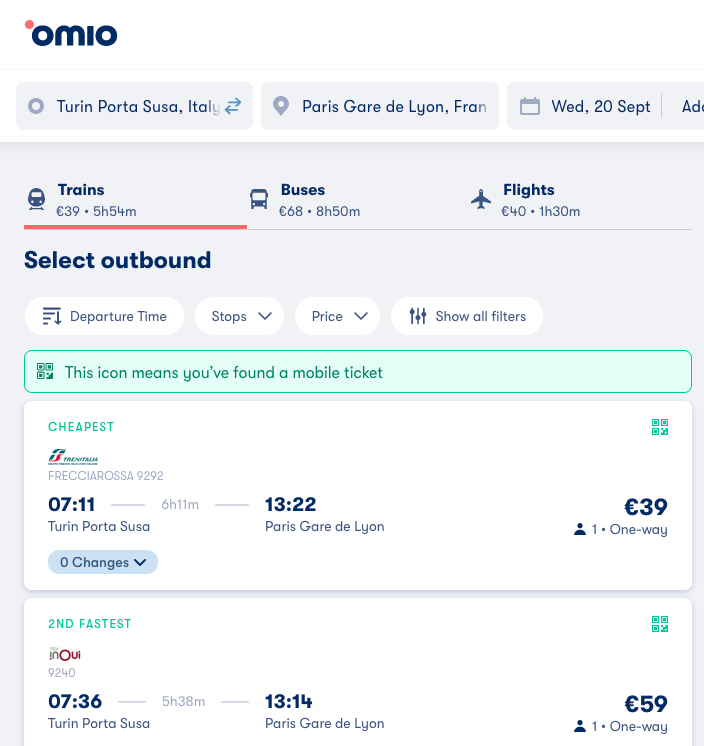

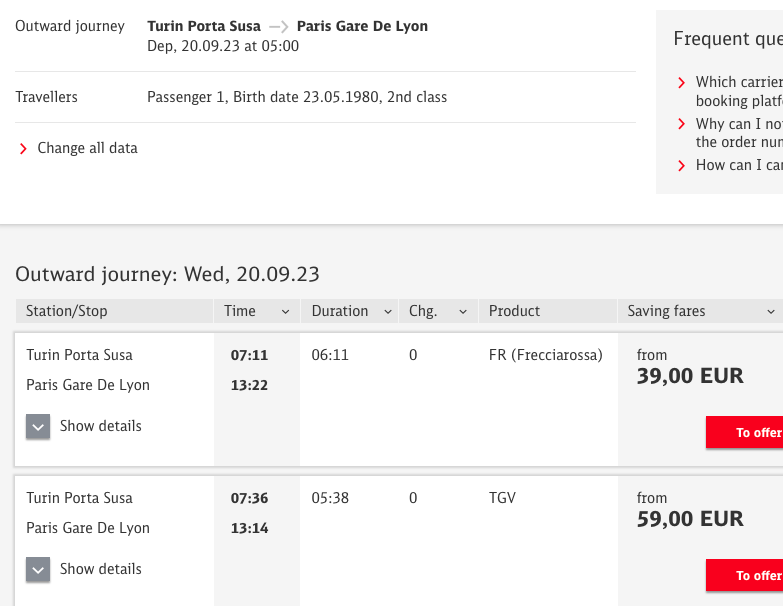

The case concerns the route between Paris Gare de Lyon (France) and Torino Porta Susa (Italy). High speed trains on the route are operated by state incumbents SNCF (TGV inOui trains) and Trenitalia (Frecciarossa 1000 trains), but competing with each other rather than working in collaboration.

Trains continue to Milan, but operators do not serve the same stations there – so Torino Porta Susa is easier for the sake of comparison as all trains of both operators serve that station. The route between Chambéry (France) and Torino (Italy) is blocked by a landslide at the time of writing, but that has no direct impact on the case study – other than a date from earlier in 2023 being used for example searches.

On the day for which test searches were performed, SNCF’s booking platform and app SNCF Connect (https://www.sncf-connect.com/) shows only SNCF trains on the route:

And Trenitalia (https://www.trenitalia.com/) shows only Trenitalia trains:

The privately owned portal Trainline (https://www.thetrainline.com/) shows both SNCF and Trenitalia trains:

As does the privately owned portal Omio (https://www.omio.com/):

But there is no legal reason state-owned railway companies cannot show both SNCF and Trenitalia trains – as both are shown on state owned Deutsche Bahn’s international portal (https://www.international-bahn.de/):

And so too on the International Portal of the Dutch state owned NS (https://www.nsinternational.com/) – SNCF and Trenitalia trains are both available:

This example shows that letting railway companies resolve these problems in an informal collaboration with each other is not going to result in the price comparison system that passengers need, because some state railways have blind spots even towards each other, while others will refuse to sell tickets of private rivals’ services (and these private rivals will likewise refuse to sell state incumbents’ tickets).

(⬆ Return to the Table of Contents ⬆)

Case Study 2 – Railway and coach companies refusing to share ticketing data makes efficient multimodal booking impossible

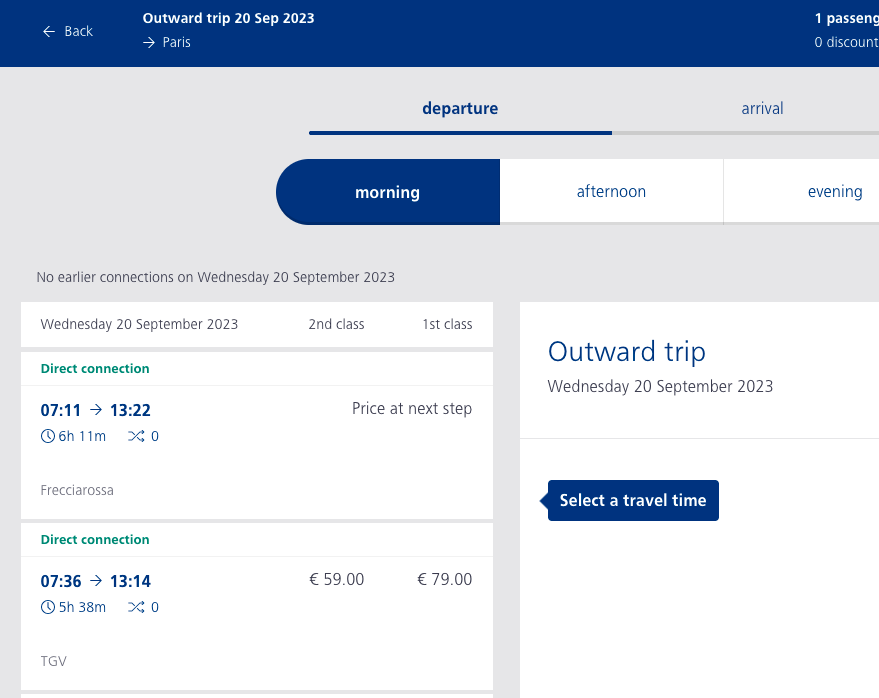

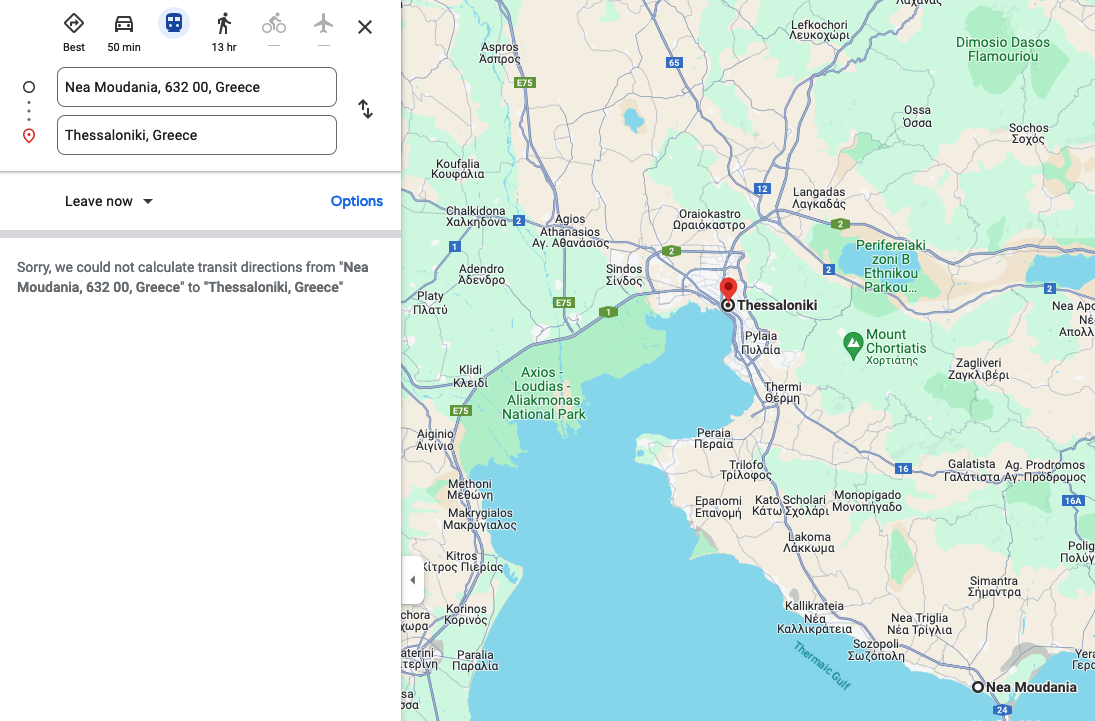

The most efficient route from Frankfurt am Main (Germany) to Nea Moudania (largest town in Chalkidiki, Greece) is to fly from Frankfurt to Thessaloniki (Aegean Airlines has direct flights), and then take a KTEL coach from Thessaloniki to Nea Moudania.

However the dedicated multimodal portal Omio (https://www.omio.com/) can find nothing for the leg to Nea Moudania:

And even Google Maps (https://www.google.com/maps/) has nothing:

The only solution is to check this manually, via the KTEL Chalkidikis site (https://ktel-chalkidikis.gr/en/index.html)

There are of course no such problems to book the flight from Frankfurt to Thessaloniki – that is available either directly from Aegean Airlines, or from dozens of flight portals.

Similar problems exist when trying to combine flights and train tickets, for example between Bruxelles (Belgium) and Gdańsk (Poland). There are no direct flights between the two, and so portals such as Skyscanner (http://skyscanner.com/) propose flights connecting in either Warszawa or München:

But there is another way – to fly from Bruxelles to Warszawa, and then take a train from Warszawa to Gdańsk.

However no third party platform can sell tickets for trains run by PKP IC, the state incumbent long distance rail operator in Poland. Not even dedicated train booking sites like Trainline (https://www.thetrainline.com/) can sell PKP IC tickets – they nevertheless propose bus alternatives:

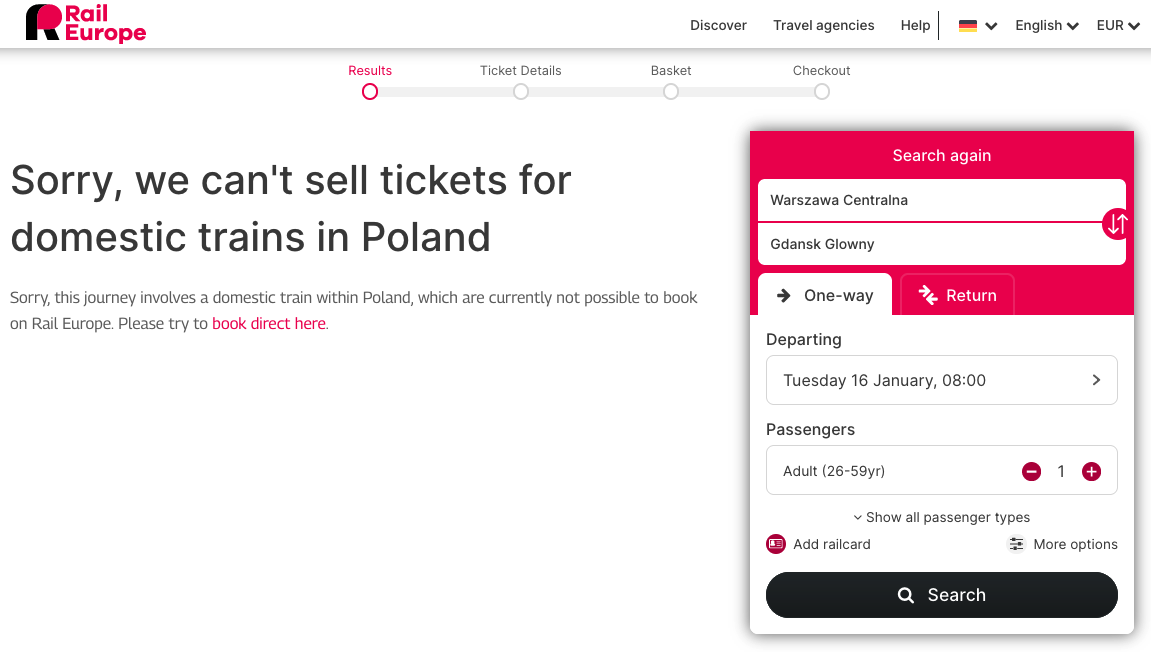

Private rail booking platform Rail Europe (https://www.raileurope.com/) has the same problem:

The only solution here is to go to the site of PKP IC (https://www.intercity.pl/) and book the train leg there, having booked the flight elsewhere.

Were the Community of European Railways (PKP is a member of CER) position to persist – where railway companies are under no obligation to allow third parties to sell their tickets – this inadequate situation could simply persist. PKP IC, or KTEL Chalkidikis in the bus case – would be under no obligation to allow third party platforms like Trainline or Rail Europe to sell their tickets.

(⬆ Return to the Table of Contents ⬆)

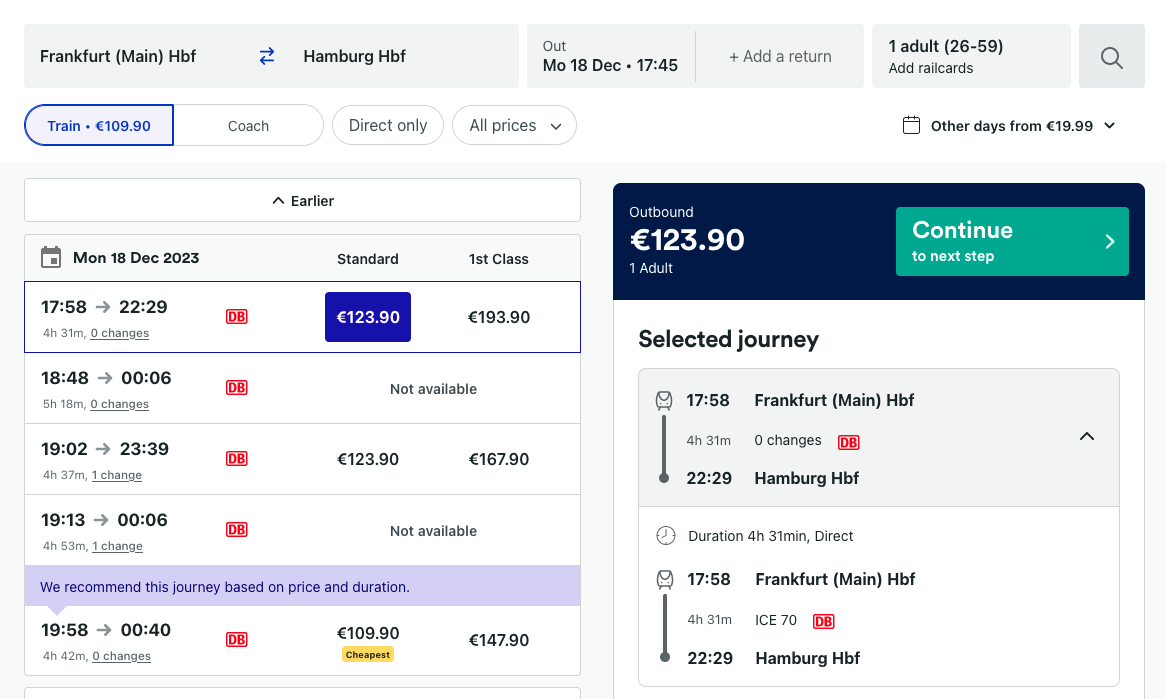

Case Study 3 – Railway companies do not pass on best price tickets to third parties

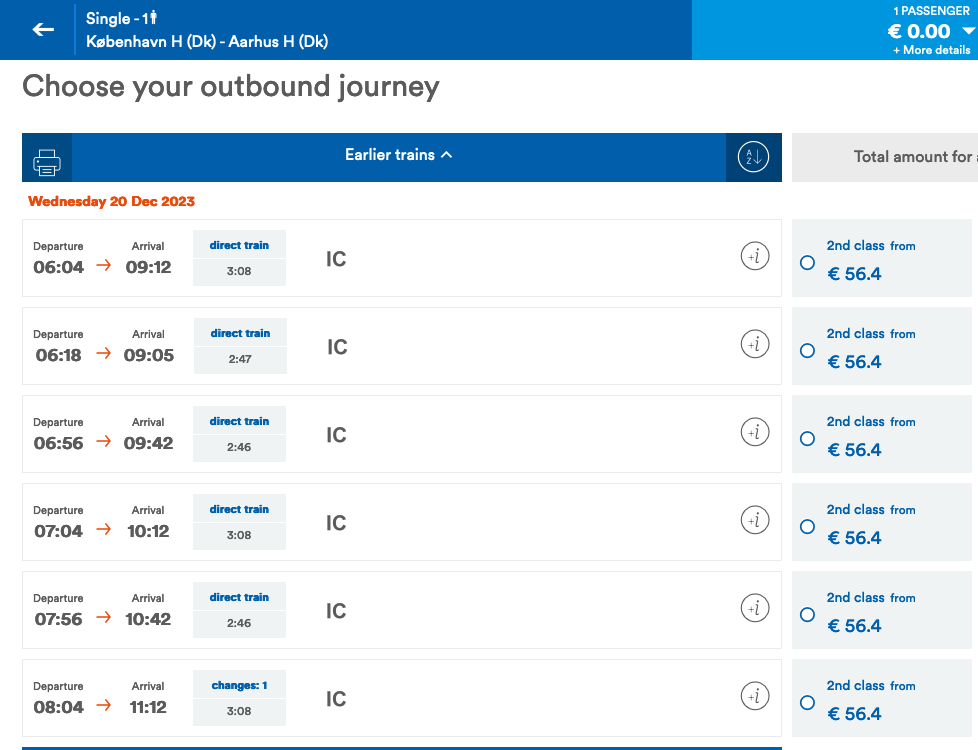

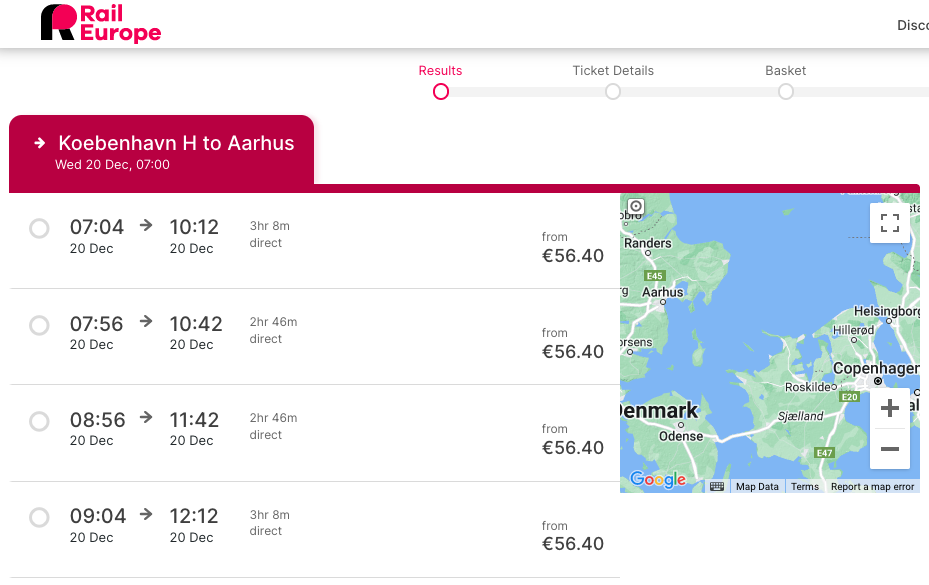

Train passengers between København H and Aarhus H (Denmark) can purchase cheap DSB Orange tickets from state railway company DSB (https://www.dsb.dk/):

DKK 258 is approx €35, DKK 429 is approx €58.

However passengers searching for the same connection on the websites such as SNCB International (https://www.b-europe.com/) or Rail Europe (https://www.raileurope.com/) only show much higher prices – €56,40 single:

Similar problems exist in Belgium and Netherlands.

SNCB (https://www.belgiantrain.be/) offers specially reduced prices for return tickets at weekends, but these are not available on other sites such as the Dutch NS International (https://www.nsinternational.com/) – there only standard price tickets are offered.

Conversely the reduced-price NS Voordeel tickets are only available from NS (https://www.ns.nl/) and not through other sites such as the Belgian SNCB International (https://www.b-europe.com/) – here standard price is the only ticket on offer.

The European Commission has announced in April 2023 that it is investigating Spanish state railway company Renfe for similar sorts of problems, namely not providing all ticketing data to third party ticketing platforms. For the preparation of this report we sought to find cases of this, but were unable to find any at the time of writing.

The central problem here is clear – at least three state incumbent railways are not allowing their cheapest categories of tickets to be sold on third party platforms, meaning passengers need specialist knowledge to get the best deal.

(⬆ Return to the Table of Contents ⬆)

Case Study 4 – Missing railway ticketing data prevents passengers getting the best price on international trains

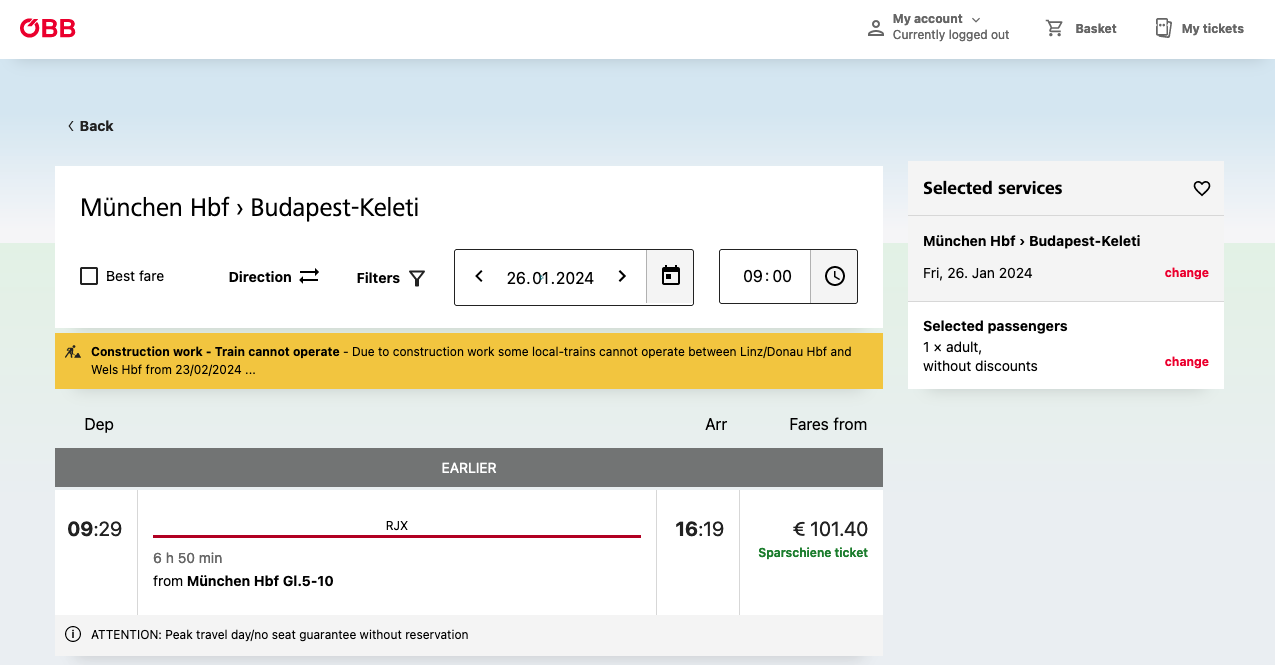

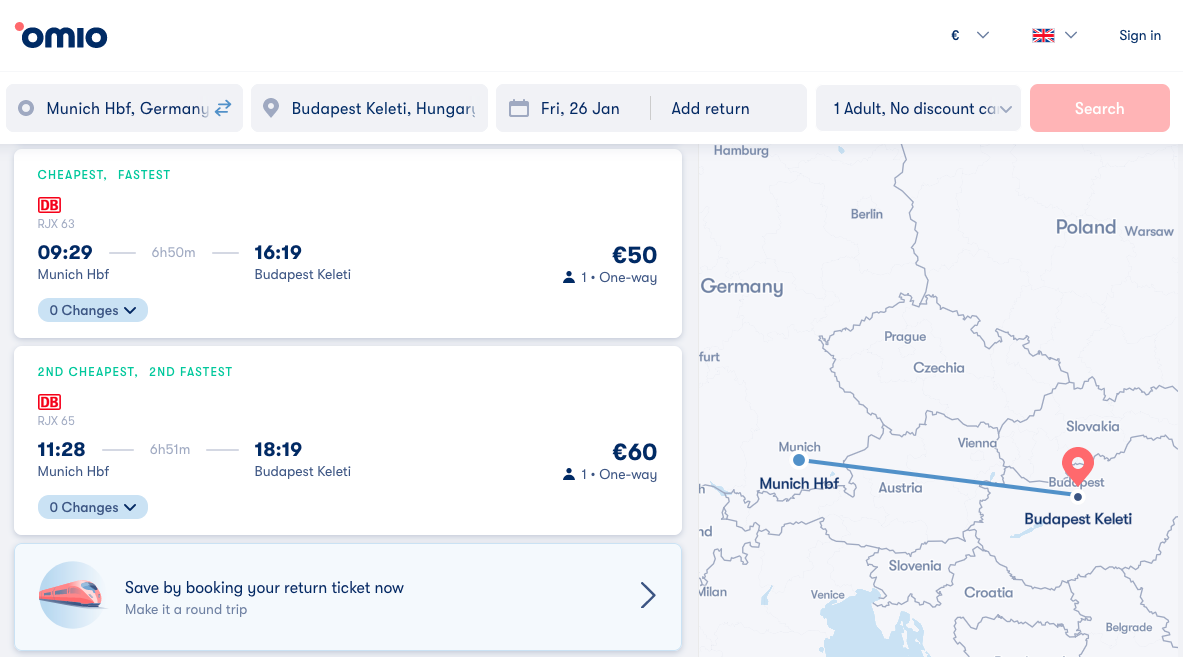

The Railjet train from München (Germany) to Budapest (Hungary) also stops in Vienna (Austria). The train itself is Austrian, and is operated in collaboration between the three state incumbent railway operators – DB, ÖBB and MÁV. However this collaboration does not extend to ticket sales and pricing.

This is Deutsche Bahn’s (https://www.bahn.de/) offer for an example trip in January 2024 – €49,90:

Here is ÖBB’s (http://tickets.oebb.at/) offer for the same train – €101,40:

And MÁV’s (https://jegy.mav.hu/) offer – €37,00:

Platforms such as Trainline (https://www.thetrainline.com/) and Omio (https://omio.com/) at least manage to show the Deutsche Bahn price, but no third party is able to show the cheapest price of all – €37,00.

That MÁV is not sharing with third party platforms is the central issue here – were it to do so passengers would have the requisite information to get the best price for a train connection like this.

(⬆ Return to the Table of Contents ⬆)

Case Study 5 – Unfair commercial practices prevent development of multimodal platforms

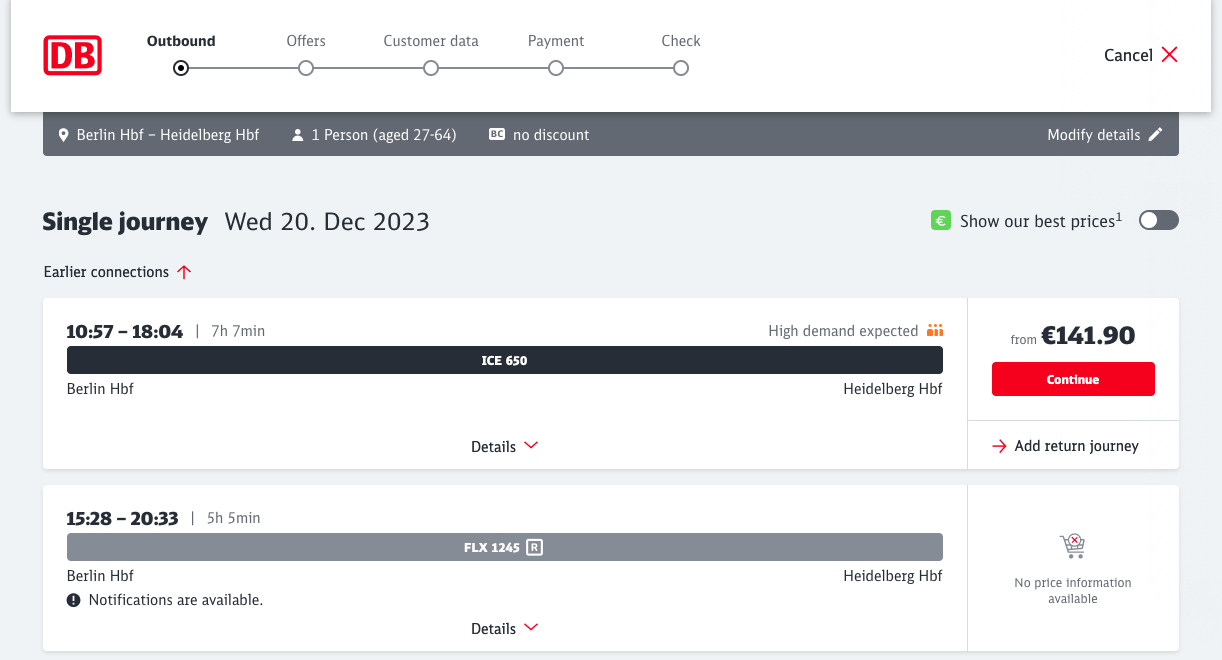

Tensions have been brewing in three countries – Spain, France and most importantly Germany – as third party ticketing platforms have been demanding not only access to ticketing data, but better terms for the re-selling of train tickets, and full access to information about timetable changes and live running of trains. Here we focus on the German case, as that is the most advanced.

Attention to the topic started in 2020, when platforms Trainline and Omio raised their concerns with the German Federal Cartel Office (BKA). “Deutsche Bahn is blocking its competitors and hindering partners by restricting their marketing activities, not providing real-time data and preventing fair commercial conditions,” Clare Gilmartin of Trainline said at the time.

The BKA in its 2023 ruling (at the time of writing being appealed by Deutsche Bahn), found in favour of the platforms. It confirmed there are problems regarding restrictions on advertising, bans on discounts, no commission for carrying out the booking and payment process, and no continuous access to real-time data.

“We want to prevent Deutsche Bahn from using its own corporate interests to extend its dominance in rail passenger transport to forward-looking mobility markets and to prevent innovative mobility providers from being thwarted,” said Andreas Mundt, Head of the Federal Cartel Office, explaining the decision. It is not only large digital platforms suffering as from the start of 2023, DB also pays zero commission to regular travel agencies when they sell Deutsche Bahn tickets.

The consequences of this Deutsche Bahn behaviour are obvious to see. DB (https://bahn.de/) will show times, but not prices, for its private rival Flixtrain:

At the same time it will show live running and estimated load of trains of its own trains on its own site, but does not make this data available to third party reseller platforms – this is the same train shown on DB (https://bahn.de), Trainline (https://www.thetrainline.com/) and Omio (https://omio.com/):

Live running data is displayed on Google Maps (https://google.com/maps/) but Google is not a ticket reseller, but instead offers a re-linking clickthrough function – directing customers to DB to purchase:

Deutsche Bahn is preventing the development of a customer friendly multimodal price comparison service by refusing to show prices for Flixtrain on its own site, and at the same time preventing third parties from developing such a comparison tool. As DB is also denying those platforms real-time data, which drives customers back to DB’s own site to find out about a disruption to their journey.

(⬆ Return to the Table of Contents ⬆)

Case Study 6 – Multimodal and multi-operator single mode journeys without passenger rights

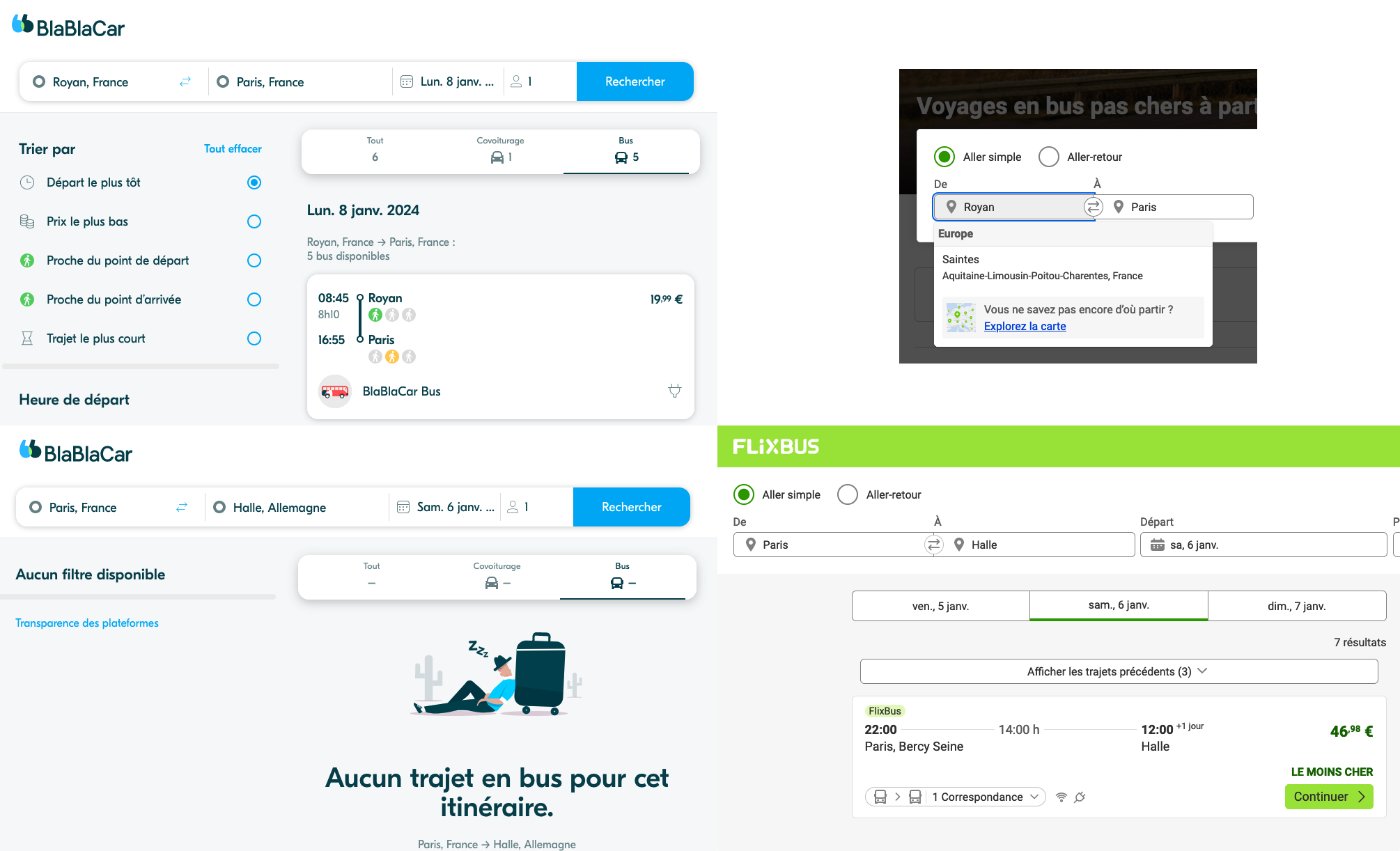

There is no way to make the journey from Royan (France) to Halle (Saale) (Germany) using one mode and one operator. The distances from both cities to airports mean that buses or trains will always be needed, but for this case we will focus only on land transport between the two.

The route between the two cities by bus is as follows:

Royan – Paris: BlaBlaCar Bus (no Flixbus or other bus operator available)

Paris – Magdeburg – Halle: Flixbus (BlaBlaCar Bus not available)

And the route by train with the fewest changes:

Royan – Angoulême – Paris: SNCF (no other rail operator available)

Paris – Halle: ÖBB Nightjet (all other train connections require a night stopover somewhere)

A multimodal trip, for example bus Royan – Paris, and train Paris – Halle, would also be possible.

The problem is that in none of these cases are a passenger’s rights guaranteed. Were the BlaBlaCar Bus delayed, a passenger has no rights to take a later Flixbus from Paris.

If the SNCF-operated Royan – Angoulême or Angoulême – Paris were to break down, and a passenger missed the Nightjet to Halle, then they would be left stranded in Paris, and would have to cover their own accommodation costs.

The state owned railways have been keen to tell policymakers how their Agreement on Journey Continuation (AJC) is designed to help passengers in these circumstances, but AJC explicitly does not cover accommodation costs. Furthermore the next train from Paris to Germany on the morning of the following day would be a Deutsche Bahn or SNCF train, and AJC only allows continuation of a trip using the same operator as the one for which a passenger has a ticket. Railteam’s Hop On Next Available Train (HOTNAT) – does not help passengers here either, as that only applies to high speed trains.

The problem is that the proposed Regulation on multimodal passenger rights would, in its current form, only help passengers in the case of an explicitly multimodal journey – so in this case if they combined a bus and a train trip, and additionally only help passengers if they booked the whole trip under one transport contract, which is currently very seldom offered by ticket sales platforms. Passengers who sought to combine buses from two companies, or trains from two companies, would still be left without any rights under the regulation in its proposed form

(⬆ Return to the Table of Contents ⬆)

Conclusions

Multimodal and multi-operator digital mobility services are obviously a very long way away from being ideal in the European Union. There are deficiencies at every stage – Trip Planning, Trip Purchase, Disruption Information and Passenger Rights.

Multimodal and multi-operator digital mobility services are obviously a very long way away from being ideal in the European Union. There are deficiencies at every stage – Trip Planning, Trip Purchase, Disruption Information and Passenger Rights.

Two of the components – Trip Planning and Disruption Information – probably do not need additional legislation at EU level, but instead need more systematic action from the European Commission to ensure that Member States deliver on their commitments to ensure that data provided to National Access Points is of an adequate quality, and is licensed to all third parties on fair terms, eliminating the problems that portals currently face.

Investigations by competition authorities – at EU level for Spain, and nationally for France and Germany – could be more widely pursued to begin to address the problems this report identifies in at least three further EU Member States.

It is in the other two components – Trip Purchase and Passenger Rights – where the legal framework at EU level is obviously inadequate, and action is required.

As the case studies in this report demonstrate, if transport operators are left to their own devices, multi-operator and multimodal purchasing is not going to emerge. The question is not whether legislation is necessary to make these sorts of purchases easier, for that need is obvious. The question is only how far such legislation should go. That the European Commission was unable to put forward a proposal on this in October 2023 is a major failure.

On the core question – re-linking or re-selling – it is clear that re-linking falls short of what customers need. Re-linking is nothing more than a glorified redirection function, and when it comes to what happens post-purchase (informing customers about disruption, and allowing customers to easily claim compensation) it is obvious that re-linking falls short.

The most obvious re-selling obligation is to mandate transport operators (including all state incumbent operators, but potentially exempting some SMEs that technically may struggle to comply) to make available all their ticketing data to third parties (the easiest way to do this is using Application Programming Interfaces (APIs) that each transport operator would provide – this way there is no need to develop some sort of central database of ticketing data), including all special offers and reduced fares. This would allow platforms – whoever owns them, either private enterprises or state owned authorities – to develop true multimodal and multi-operator trip planners that include ticket sales, knowing the data they could access would be adequately complete.

Some policy actors – notably AllRail (the lobby of EU private railway operators) – have argued for a further resale obligation on incumbent multimodal ticket platforms that have a dominant market position, meaning these dominant platforms should be obliged to re-sell all tickets for all operators. For example DB Navigator has a hugely

pre-eminent position in the German public transport apps market (stats here), but tickets for private rivals to Deutsche Bahn such as Flixtrain are not sold there (see Case Study 5).

From the outset this report has simply sought to consider the multimodal ticketing issue from the customer point of view, and has been neutral as to who should own and operate the multimodal and multi-operator sales channels of the future. Hence at this time we cannot conclude a resale obligation on incumbent platforms is necessary or desirable, as better tools will be able to be built once all operators are obliged to make their ticketing data available to third parties.

Re-selling has to be based on FRAND (fair, reasonable, and non-discriminatory) terms, and importantly there must be recourse for re-selling platforms in the case that these principles are disputed – and mechanisms for that must be covered by an eventual Regulation on Multimodal Digital Mobility Services. Given that ticket re-sellers need to foot the costs for processing credit card payments, commission paid needs to be enough to ensure at least that a re-seller’s costs are covered.

The argument made by some transport operators that such an obligatory re-selling system would impose unfair and excessive information technology costs on them is not convincing. Making it easier to purchase multimodal and multi-operator tickets (regardless of who sells these tickets) will mean greater ticket sales, and hence increased income, that will more than outweigh marginally higher technical costs faced by operators. In addition, FRAND terms should be two-way, meaning the operator also has rights vis-à-vis the third party vendor to ensure business transactions work for both sides.

The situation with regard to multimodal passenger rights is at least a step further ahead than for ticket sales, in that there is a Proposal for a Regulation from the European Commission already, but this draft is going to need amendment in order to cover multi-operator journeys as well as multimodal ones. In its current form the Regulation affords more rights to a passenger taking a bus and a train than it does to a passenger taking two trains from different operators for their journey. The principle to guide the European Parliament and the Council of the European Union in their negotiations is clear – that the way a passenger chooses to compose their trip, and how many modes or operators they choose, should not have a negative impact on their passenger rights.

The issue of liability in the case of missed connections (Article 10 of the proposal) is a further area of concern, given it offers a major carve out for carriers and intermediaries to not offer compensation if this is communicated clearly enough to customers. From a customer point of view a system where carriers could compensate each other in the case that the delay caused by one caused a disruption later in the travel chain would be preferable. Further, placing financial responsibility on the shoulders of an intermediary could well further prevent genuine multimodal platforms from emerging, as the margins from re-selling tickets could well be so low so as to mean the additional burden of liability in the case of claims cannot also be met.

As a new European Parliament and a new European Commission start their work in 2024, the urgent need for action on this topic is clearer than ever. As this paper has demonstrated, in all of the four components of Multimodal Digital Mobility Services (Trip Planning, Trip Purchase, Disruption Information and Passenger Rights) there are serious issues, both legislative and non-legislative, that needs to be addressed. Millions of Europeans are eagerly awaiting better conditions for train travel across Europe and the EU cannot afford to disappoint them again.

(⬆ Return to the Table of Contents ⬆)

This report was commissioned by MEP Jakop Dalunde, Greens/EFA and written by Jon Worth (jonworth.eu). Research for the report was conducted in Autumn 2023 and the report was published in March 2024.

The report is released under the Creative Commons Attribution-ShareAlike 4.0 International (CC BY-SA 4.0) License – you are free to share and adapt the work, but you must attribute.

Back cover photo: Leif Jørgensen – Movia bus line 8A and S-train line A at Nordhavn Station in Østerbro in Copenhagen – 31 May 2015 – CC BY-SA 4.0